Streamlining Bank Statement Processing

for EquiRise Finance

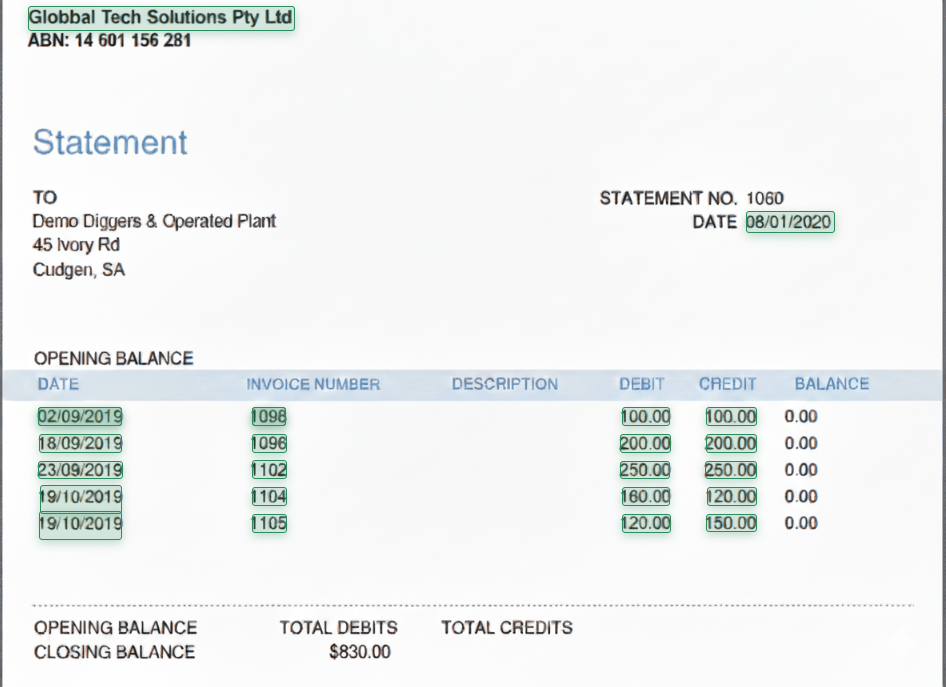

EquiRise Finance, a financial services company, processed over 12,000 bank statements monthly from various financial institutions for loan applications and financial analysis. Each statement required manual data extraction for income verification, expense categorization, and risk assessment. The diverse formats from different banks, including digital PDFs and scanned documents, created significant processing delays and potential errors in credit decisions.

Disclaimer: This image is for demonstration purposes only and is not related to any real customer.

12,000+ monthly bank statements from multiple financial institutions requiring detailed transaction analysis and categorization.

Different bank statement formats, layouts, and quality levels from various financial institutions creating processing inconsistencies.

Manual processing bottlenecks delayed loan approvals and financial assessments, impacting customer satisfaction and business growth.

- AI-powered bank statement data extraction and parsing

- Automated transaction categorization and analysis

- Income and expense pattern recognition

- Multi-bank format compatibility and standardization

- Real-time financial risk scoring and reporting

Bank statement analysis time reduced by 91%, from 2 hours to 11 minutes per statement, accelerating loan decisions.

Achieved 98.7% accuracy in transaction categorization and financial data extraction across all bank formats.

Processed 60% more loan applications with same staff, generating $2.1M additional revenue while reducing processing costs by 73%.

EquiRise Finance transformed their financial analysis capabilities through intelligent bank statement processing automation. The solution not only accelerated loan decision-making but also improved risk assessment accuracy through consistent data extraction and analysis. By eliminating manual processing bottlenecks, the company achieved significant operational cost savings while scaling their lending operations and enhancing customer experience through faster approval times.

More Case Studies

CargoSphere

No more wasted time on manual entry. We use it daily to extract from PDFs and images.

Axentro Cargo

Capture Fields saved us hours of manual work. Upload, relax, and done! Super easy to use.

NextWave Capital

It doesn't matter what format or layout-Capture Fields adapts and extracts the right info every time.